lincoln ne sales tax 2020

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. Lincoln To See New Sales Tax Revenue Starting October 1 General Fund Receipts Nebraska Department Of Revenue 2 Nebraska S Sales Tax Refundable Income Tax Credit For.

1800 per 31-gallon barrel or 005 per 12-oz can.

. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The city needs an additional 34. La Vista NE Sales Tax Rate.

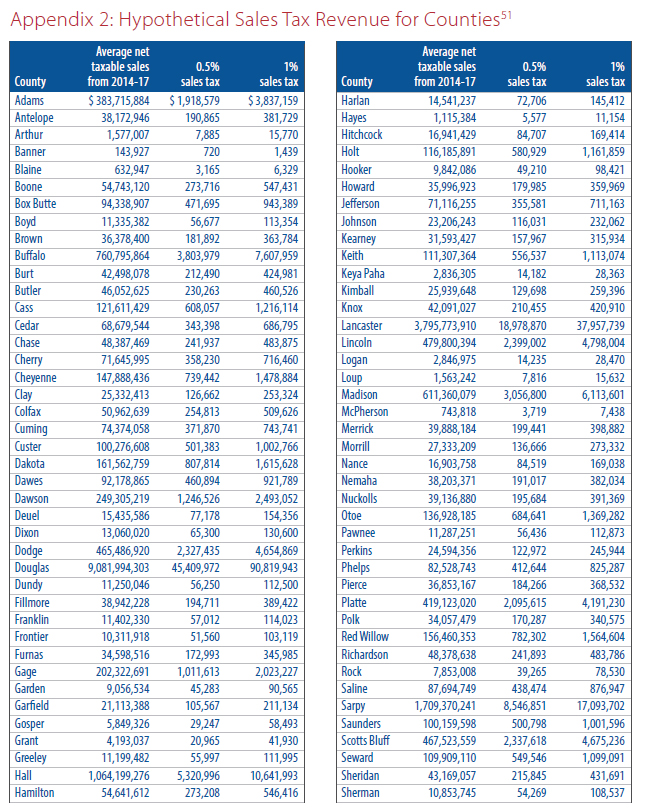

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 583 in Lincoln County Nebraska. The State Legislature authorized an increase in the local sales tax by a vote of the people. The Nebraska state sales and use tax rate is 55 055.

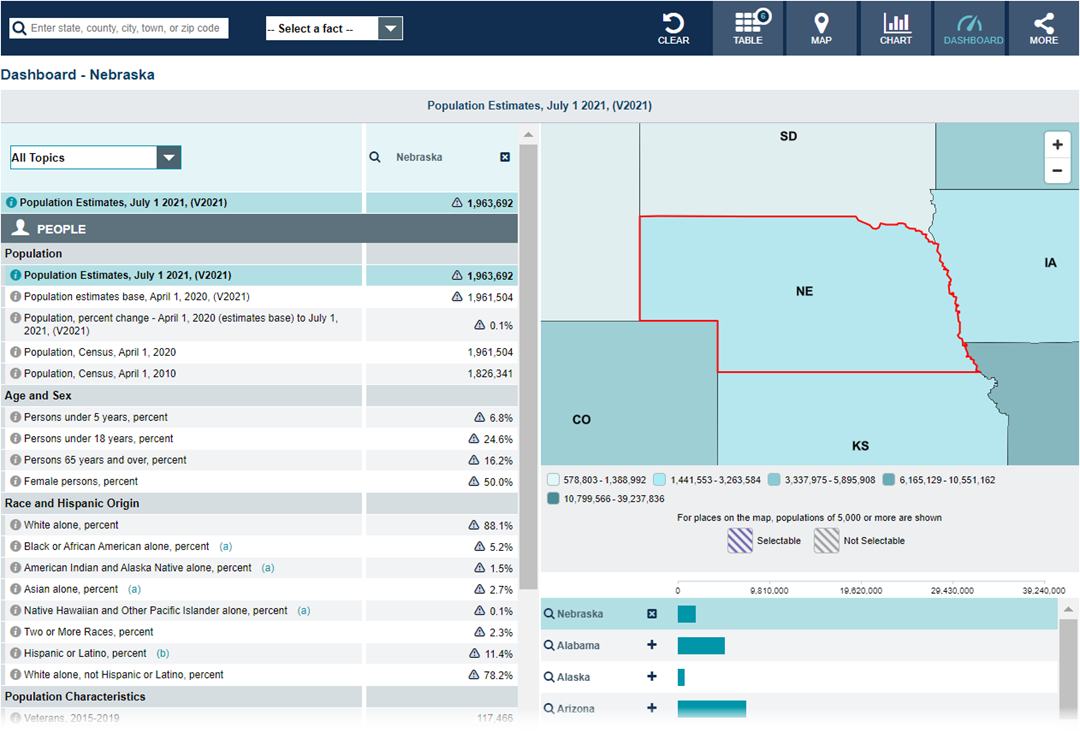

The current total local sales tax rate in Lincoln County NE is 5500. The Nebraska sales tax rate is currently. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725.

A continuation of any. Federal excise tax rates on beer wine and liquor are as follows. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. Lexington NE Sales Tax Rate. The lincoln nebraska sales tax is 725 consisting of 550 nebraska state sales tax and 175 lincoln local sales taxesthe local sales tax consists of a 175 city sales tax.

Lincoln County NE Sales Tax Rate. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. There is no applicable county tax or.

The most populous location in lincoln county. McCook NE Sales Tax Rate. Vacant land located at 1228 S 89TH ST LINCOLN NE 68520 sold for 39000 on Nov 25 2020.

025 lower than the maximum sales tax in NE. The December 2020 total local sales tax rate was also 5500. The december 2020 total local sales tax rate was also 7250.

The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln NE Sales Tax Rate.

All numbers are rounded in the normal fashion. It has been nearly a year since the quarter-cent sales tax took effect here in Lincoln and as construction season wraps up were getting our first look at where the projected 13. This includes the rates on the state county city and special levels.

The sales tax cannot be extended beyond the period authorized by the voters. 49 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards. The most populous location in lincoln county.

This is the total of state county and city sales tax rates. 107 - 340 per gallon or 021 - 067 per 750ml bottle. View sales history tax history home value estimates and overhead views.

Kearney NE Sales Tax Rate. The exact fee will be calculated at the time. Changes in Local Sales and Use Tax Rates Effective January 1 2020 Nebraska Department of Revenue.

The Nebraska state sales and use tax rate is 55 055.

Nebraska State Tax Things To Know Credit Karma

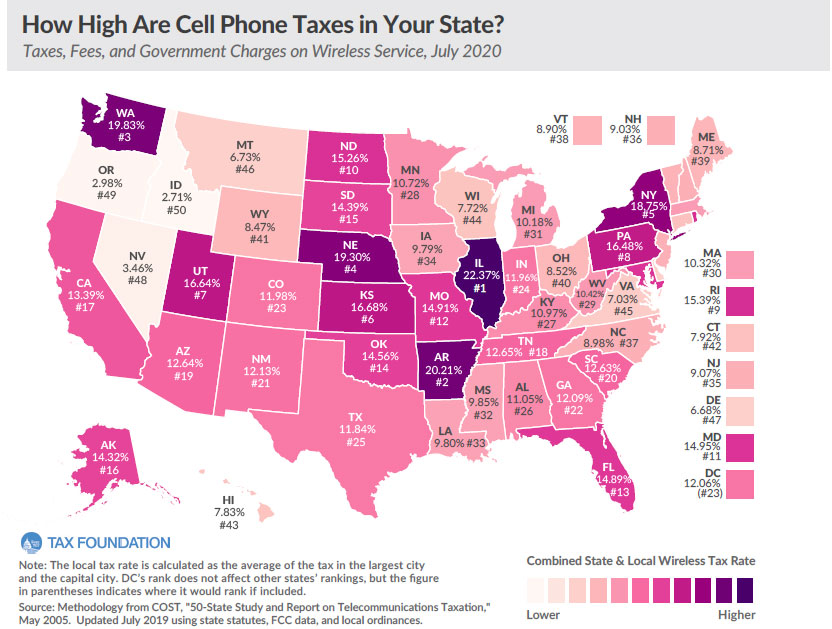

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Nebraska State Tax Software Preparation And E File On Freetaxusa

Used And Certified Pre Owned Cars Trucks Suvs For Sale In Lincoln Ne

Prepare And File A Nebraska Income Tax Amendment Form 1040xn

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Subaru Inventory For Sale In Lincoln Ne Duteau Subaru Near Milford

Nebraska Sales Tax Rates By City County 2022

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Nebraska 155th State Admission Anniversary 1867 March 1 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

State And Local Tax Collections State And Local Tax Revenue By State